A happy retirement is not something you wish for. You have to plan for it and make it happen. You’re not going to work forever so it’s important to come up with a plan of how you’re going to take care of your financial needs when you stop working.

Retirement is easily one of the biggest decisions you’ll have to make. It ranks in the same league with decisions like marriage and having children. A good retirement is one that gets you a pension plan that works for you. Let’s highlight some questions that you’ll need to deal with when planning your retirement.

Table of Contents

When Should Retirement Planning Begin?

The best time to start preparing for your retirement is 5 years before the date you plan to retire. This gives you enough time to plan your short term and long term financial goals. Once you are five years to your retirement date, avoid procrastinating any further.

5 years might seem like a long time but you’d be surprised by how quickly the years fly by.

What Are 3 Signs That Show You Need to Start Thinking About Retiring?

There are subtle signs that help you understand that it’s time to take your retirement planning seriously.

1. You Hit a Brick Wall

If you get to that point where you didn’t see your career advancing beyond that point, this might be a sign it’s time to throw in the towel. For instance, if you have worked in senior managerial positions for a minimum of 10 years, you should consider retiring.

2. When Your Health Takes Priority

There will come a time when your age will not permit you to engage in prolonged physical and mental stress. As you approach this point, you should consider retiring. In Nigeria, the retirement age is pegged between 60 and 65 years.

3. When You Attain Career Fulfilment

Career fulfilment is that point in your career progression when you feel energized, motivated and deeply satisfied with your career. Some attain this point early while it comes late for others. When you reach this point, you should consider retiring. Retiring doesn’t mean you can’t be a mentor to the younger generation.

How Do You Plan For Retirement?

You can’t fold your hands and expect your retirement to happen. It requires planning and some level of sacrifice. Retirement isn’t merely about saving money. There’s more to be done if you are looking forward to a happy retirement.

1. Get Professional Guidance

Educating yourself is a crucial part of planning your retirement. No one will pay as much value on your money as you personally do. It’s important to seek guidance on investment opportunities.

Plan your retirement with an open mind and focus on ways you can secure your income and make it grow. Some of the things you can do include visiting jobs and career blogs to educate you. You can also take up an investment class online or offline or read books on proper retirement planning.

2. Spread Out Your Investments

Don’t put all your eggs into when planning your retirement. Instead of taking all the money you have set aside for retirement and investing 100% into either animal farming or cryptocurrency, consider going for a mix of investments that will help you generate income with minimal risk.

Remember that your investment portfolio goes a long way in determining how much income you will have during retirement as well as how long it will last.

3. Find Out How Much You Need to Retire

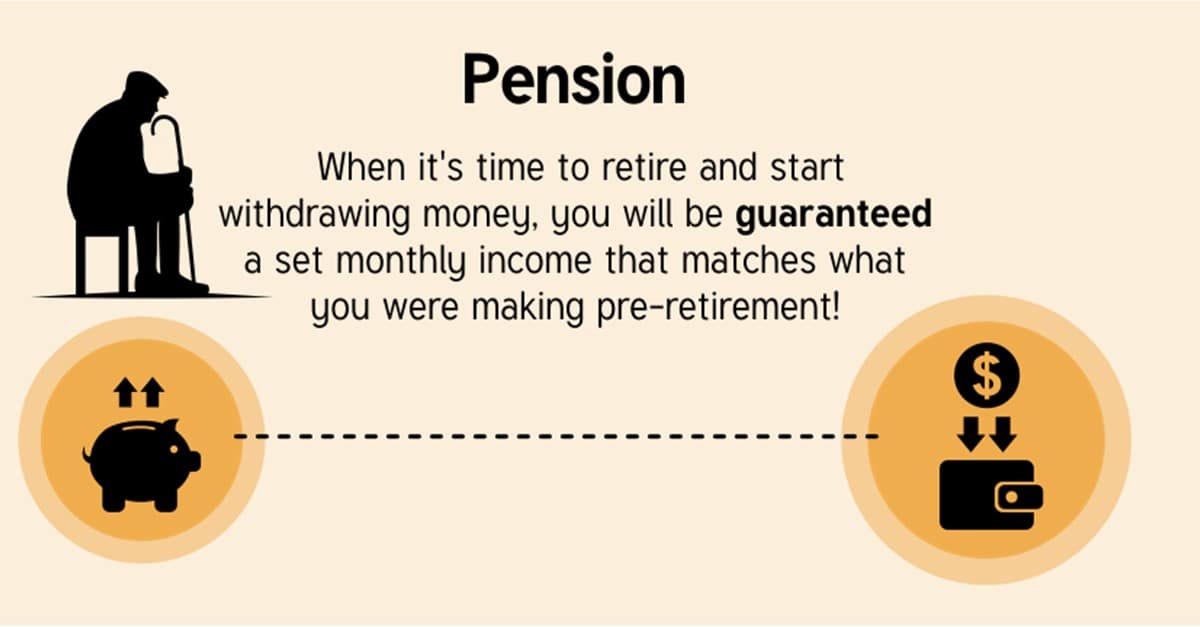

You can’t retire without having income and investments to fall back on. You will fare better in retirement if you have enough money in your ‘mutual funds’ investment that gives you an interest of N200,000 monthly than if you don’t. Based on current rates, you would need an investment of around N10 million to be guaranteed of this monthly return.

To know if you have enough money to retire, you have to come up with an estimate of your monthly income and spending. As boring as this might seem, it is a crucial part of your retirement plan.

Measure your current income against your current monthly expenses. Next, write down the income you will generate from your pension and other investments. How do they stand when compared to your monthly expense? If there is a deficit, consider cutting down on your expenses, investing more or working some extra years.

4. Increase Your Cash Reserve

Applying for your pension takes a bit of time depending on whether you work in the civil service or a privately owned establishment. You should find a way to increase the amount of money you have set aside in your savings and investment portfolio. This helps you prepare for any delay you might encounter when you eventually retire.

Wondering how much you need to set aside? Your range should be enough to take care of your living expenses for 4-6 months.

What Are the Stages of Retirement?

There are 5 stages of retirement planning and you should pay attention to what you should be doing at each phase.

Stage 1: Accumulation

This is the phase where you actually begin to work and start putting some money aside for your future needs. Strive to save as much as you can.

Stage 2: Pre-Retirement

This is the stage of your career when you clock 50 years old. It is also the point where you are 15 years away from retirement. Focus on finding ways to convert your retirement savings into a steady stream of income.

Stage 3: Early Retirement

This phase runs from the moment when your retirement begins till you are 70 years old. Here, you should assess your finances and how your retirement savings are faring.

Stage 4: Mid-Retirement

This phase kicks in when you are 70 years old and lasts for as long as you enjoy good health. Have a detailed conversation with your family and loved ones on what to do if your health ever deteriorates.

Stage 5: Late-Retirement

This is the stage of your retirement when you need help to move around to do even the most basic things. This is the point where you hope that all the planning you have done prior to this time makes the rest of your life as manageable as possible.

Since you spent a greater part of your life earning money, a good portion of your planning time should go into arming yourself with investment opportunities and advice from seasoned investment professionals on ways to make your money work for you.